PharmAla is the first for-profit company to synthesize clinical-grade (GMP) MDMA and make it available for sale to both researchers and qualified patients. PharmAla will increasingly develop a target on its back for acquisition and we expect a rise in marketcap via share price appreciation over the coming months as markets open up and the reality of the company’s unique position is appreciated by the marketplace. Market Equities Research Group has a near-term (12 month) price target for PharmAla Biotech Holdings Inc. of C$1+/per share for CSE: MDMA.

PharmAla Biotech $MDMA Investor Ecstasy Just Beginning

SHARE DATA, MARKETCAP, CORPORATE INFO:

PharmAla Biotech Holdings Inc.

CSE stock symbol: MDMA

Share Price: ~$0.185 Canadian on CSE

Market Cap: ~$15.4M Canadian

Shares Outstanding: ~$83 Million

Key statistics: https://finance.yahoo.com/quote/MDMA.CN/key-statistics?p=MDMA.CN

Company website: https://pharmala.ca

—— —— —— UPDATE: This buy recommendation was closed May 15, 2023 at $0.43/share (for 100%+ profit), consider at least taking a free-ride by selling half (thus recouping your initial investment) and letting the balance ride. —— —— ——

PharmAla Biotech Holdings Inc. (CSE: MDMA) is a Canadian-based biotechnology company specializing as a global supplier of unique key pharmaceutical ingredients for research. PharmAla is the first for-profit company to synthesize clinical-grade (GMP) MDMA and make it available for sale to both researchers and qualified patients. The company’s flagship product is LaNeo™ MDMA (a Controlled Substance). The company also R&Ds novel analogues of MDMA; the company has developed its proprietary ALA series of molecules – of particular note is PharmAla’s premier drug candidate, ALA-002, it shows significantly improved cardio and neurotoxicity profiles, as well as a significant reduction in hyperthermia, the major adverse event associated with MDMA. PharmAla’s ABA series of Novel Chemical Entities (NCEs) also have significant toxicology benefits, and are not considered Controlled Substances in many jurisdictions, including Canada.

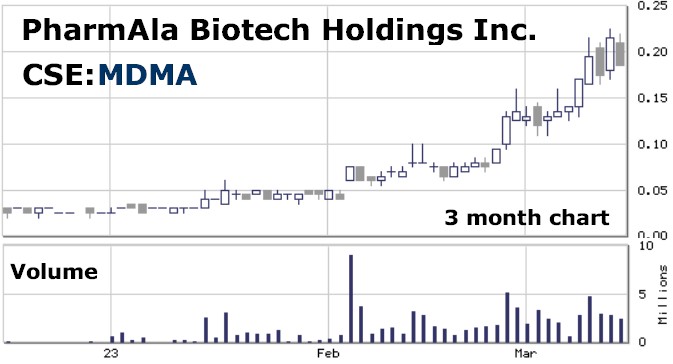

PharmAla Biotech’s stock chart has been on a tear lately:

Figure 1. (above) 3 month chart of CSE: MDMA

Part of the reason why MDMA stock has done so well over the last few weeks is because on February 3, 2023 Australia announced that they were going to allow for the use of MDMA as a medical treatment for the treatment of post-traumatic stress disorder (see related news release Australia Allows Prescription of MDMA and Psilocybin in Groundbreaking Regulatory Change ). On a regional basis Australia represents a market of ~28 million people, however on macro-view it represents just the very tip of the iceberg of what is coming in terms of a nascent global shift in treatment protocols/acceptance: e.g. MDMA has been granted “Breakthrough” status by the FDA. In addition to treatment for individual sufferers of PTSD, MDMA is under evaluation as a potential treatment for couples therapy, eating disorders, alcohol addiction, anxiety, and depression. The first Phase 3 clinical trial for MDMA has been successfully published; MDMA will be submitted for New Drug Approval (NDA) to the USFDA in 2024.

PharmAla Biotech Holdings Inc. (CSE: MDMA) has a nominal marketcap of ~C$15.4 million (82,998,600 shares outstanding (source: StockWatch) trading at ~$0.185), and there is only ~1 million warrants outstanding, almost all at 10 cents. The company has sufficient funds to excel in operations and execute on plans (no need to dilute its share structure) – the company generates sufficient income from established institutional research entities globally.

As a pharmaceutical manufacturer PharmAla Biotech synthesizes its own API (active pharmaceutical ingredients) at licensed GMP facilities – it maintains an asset-light model; not having to build-out its own labs, it utilizes existing contract manufacturers, and focuses on owning the intellectual property that underpins that manufacturer.

In a country like Australia, which has just flipped, it obviously makes no sense for PharmAla to continue exporting to from Canada; the plan is to physically meet with all the preeminent contract manufacturers in Australia, and have them compete for PharmAla Biotech’s business to manufacture PharmAla’s molecules on an exclusive basis. This gets rid of all the rigmarole of import-export of a controlled substance. In facilitating research for this article, the author received a return phone call from the CEO of PharmAla Biotech from Australia where Nicholas Kadysh was facilitating business — no material news was disclosed– but it is telling that he is actively engaged where he needs to be in order to take PharmAla to new heights and take advantage of the company’s unique niche in this nascent sub-sector. In terms of strategy, the CEO was very explicit in his shareholders letter, which was released about a month ago, that its goal would be in the first six months to onshore manufacturing in Australia, to establish distribution, and basically just be ready for the start of a commercial market. It is clear no one else can beat PharmAla to the markets, because it is the only one that I’m aware of, other than the non-profit MAPS, that has a stockpile of GMP material ready to ship and manufacture. PharmAla Biotech is by far and away the biggest supplier of research materials to Australia in this category, the company has a remarkable relationships with the regulator in Australia, and with several major research universities.

Investment Thesis: Market Equities Research Group provided the author the following price target commentary; “Now that Australia has flipped and is on-board with regulatory approval of MDMA, the question begs “Which country will be next to provide regulatory approval?” — We don’t have a crystal-ball, however the sentiment out there by ‘those in-the-know’ is that there will be others. Prior to Australia flipping there was nobody else who could legally purchase the materials PharmAla made — so PharmAla had been working as vendor to a wide range of universities (e.g. University of California, University of Sydney, and University of Melbourne). With Australia now on-board things are getting interesting and it is time for PharmAla to shine and leverage its unique position, IP, expertise, and know-how. With a current nominal marketcap of only C$15.4M CSE: MDMA presents opportunity. PharmAla will increasingly develop a target on its back for acquisition and we expect a rise in marketcap via share price appreciation over the coming months — Market Equities Research Group has a near-term (12 month) price target for PharmAla Biotech Holdings Inc. of C$1+/per share for CSE: MDMA. Additionally, on the R&D front, the ALA 002 drug candidate is hoped to be in clinical trial before the end of the year. Also of note, since November 2022, PharmAla has been selling GMP Psilocybin, as an exclusive global reseller for Mindset Pharma Inc.”

PharmAla’s management team:

Nicholas Kadysh, CEO

Dr. Shane Morris, COO

David Purcell, Director of Sales

Carmello Marelli, CFO

Harpreet Kaur, VP, Research

PharmAla’s Board of Directors:

Jodi Butts, Board Chair (CV note: Aphria)

Nicholas Kadysh, President (CV note: Past leadership roles with Red bull, GE, JUUL)

Fraser Macdonald, Director (CV note: Norton Rose Fulbright)

Prof. Harriet De Wit, Director (CV note: Professor at U of Chicago and Editor of Psychopharmacology)

Perry Tsergas, Director (CV Note: Spark Advocacy)

Dr. Malik Slassi, Director (CV Note: Trillium Therapeutics)

Kevin Roy, CPA, Director (CV note: First Service)

The following URLs have been identified for additional DD on PharmAla:

Company website: https://pharmala.ca

SEDAR: https://sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00051318

Yahoo Finance stats & charts: https://finance.yahoo.com/quote/MDMA.CN/key-statistics?p=MDMA.CN

GlobeNewswire News: https://www.globenewswire.com/search/keyword/PharmAla%252520Biotech?pageSize=10

##

Notice: Content above may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned.

Disclosure: The subject company of this article is not a client. Investor Opportunity has full editorial control of this article. The author has not been compensated to cover the subject company on Investor Opportunity. The author and/or its trading desk affiliate either owns now or plans on establishing a long position in the subject company.