A world class hydrogen asset in the making. The level of interest from large industry players now following QI Materials’ hydrogen exploration efforts is significant. Chances are QIMC will not exist in a year or so as with every positive news release it increasingly becomes a target for acquisition.”

QI Materials $QIMC Oceans of Buried Natural Hydrogen

SHARE DATA, MARKETCAP, CORPORATE INFO:

Québec Innovative Materials Corp.

Stock symbol QIMC (on CSE)

Share Price Recently traded C$0.21 – C$0.34

Market Cap ~$25 Million Canadian

Shares Outstanding ~105 Million

Company website: https://qimaterials.com

—— —— ——

Québec Innovative Materials Corp. (CSE: QIMC) (Frankfurt: 7FJ) (a.k.a. QI Materials) secured the most prospective natural (white) hydrogen claims in the Province of Québec as recommended by the Institut National de la Recherche Scientifique (“INRS”) following 6 years of comprehensive research headed by Professor Richer-LaFlèche, P.Geo. INRS is a Québec graduate research funded university organization with one of the biggest geo-labs in Québec. In-short, QI Materials hydrogen undertaking is backed by deep science and geology. Professor Richer-LaFlèche indicated to QI Materials which areas his model pointed, based on research papers that had come from Australia (e.g. the successful Ramsey Hydrogen Project which is currently valued at several times the current market cap of QIMC), where he noticed a lot of similarities in terms of rock type and fault systems. The INRS had developed a soil sampling methodology for the presence of natural hydrogen and areas of Southern Québec were scoring high. QI Materials now controls ~90% of the hydrogen showings within the province of Québec and has partnered with the INRS to systematically reveal the enormity of what it possesses.

Oceans of Buried Natural Hydrogen

There are three large main claim groups in the province that match the criteria and QI Materials has staked them all; 1) Ville Marie Hydrogen Project, 2) Lac St. Jean Hydrogen Project, and 3) Gaspe Bay Hydrogen Project. Unlike a mine, where metals tend to be found in localized pods, with gases they tend to be homogeneously consistent over very large distances. QI Materials has the best of the best in terms of prospective claims that fit model criteria. A major international player that has recently staked large areas of BC using similar hydrogen bearing rock model criteria have let it be known that Quebec was actually their first choice of areas to stake, but QI Materials had already beat them to the punch. The first pass testing of only the first sliver (~1/5) of the Ville Marie Hydrogen Project has yielded phenomenal concentrations and purity. Understanding IRNS’ model and the consistent homogeneous nature of gases that emanate from bedrock meeting the model’s criteria, the likelihood of additional hydrogen discovery success is very high on the rest of the claims. A section of the Lac St. Jean Hydrogen Project claims are to be first-pass tested beginning in November-2024.

The hydrogen being encountered by QI Materials is genuine natural (white) hydrogen resulting from water passing up thru the fault system and geochemically reacting with the specific type of basement rock that INRS’ model called for (rich in iron, potassium, radon, etc…), that geochemical reaction takes out the “O” from the H20, leaving pure hydrogen to seeps upward. QI Materials does not have issues with false positives that some other hydrogen exploration companies have (in other areas of the globe), via anthropogenic causes (such as corrosion of wells creating hydrogen), or coming from bio-generation (whereby bacteria in the soil breaks up and produce hydrogen).

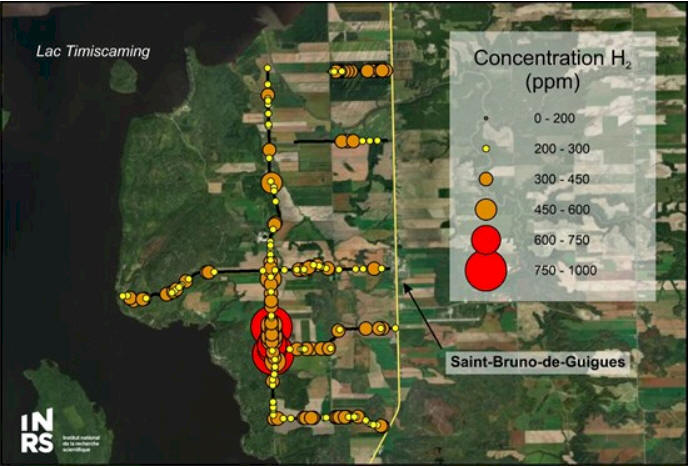

Remarkable Hydrogen Values – Potentially a World Class Hydrogen Asset: See September 4, 2024 news release “QIMC Announces Landmark Discovery of Hydrogen Soil Samples over 1000ppm on Recently Completed 9.7km North-South Line, Outlining Highly Charged 70km2 Hydrogen Area“; “…the findings from the recently completed 9.7km north-south line 7 have uncovered hydrogen soil samples with concentrations exceeding 1000 parts per million (ppm). Significantly, we observed 8 readings exceeding 600 ppm, with 2 of those surpassing 1000 ppm. Additionally, the average measured 531.9 ppm over a 450 ms interval between the readings above 1000 ppm.“

Figure 1 (above) – a 70 sq. km area with multiple hydrogen hot zones at Ville Marie. This is only the tip of the iceberg, QI Materials is equally prospective on the whole 250 sq. km of claims at Ville Marie alone.

The data to date at Ville Marie suggest there to be multiple secondary reservoirs/hot zones that are linked to a principal reservoir, which is the fault itself. The readings of 200 – 300 ppm would be thicker sandstone, verses thinner areas proximal the fault allowing for the higher readings at surface.

QI Materials is conducting advanced gravimetry and audiomagnetotellurism (AMT) geophysical surveys. The gravimetry surveys will help identify areas most likely to contain valuable reservoir rocks by focusing on assessing variations in the thickness of local sedimentary rock deposits, known as gravity troughs, over the Archean basement. The AMT surveys will be instrumental in locating graben-related faults in the St-Bruno-de-Guigues area.

The Saudi Arabia of Hydrogen analogy some have made of QI Materials comes from the fact that the now proven INRS model has huge district-scale area of potential, involving a phenomena where the hydrogen is continually flowing, the hydrogen when taken out of the ground is replenished. There is potentially enough hydrogen to be tapped to supply the needs of millions of people and scores of industry for centuries.

Besides the best location for geological formation, location-wise QI Materials’ claims are in favourable jurisdiction for transportation and supportive government; located in the southern part of the province of Québec. Half of the population of Canada lives in southern Ontario and Québec and there are ports nearby to facilitate in-situ transport (e.g. converted to ammonia or methanol) internationally. The Québec government has an ambitious goal of reducing GHG emissions by 37.5% from 1990 levels by 2030, and it recognizes hydrogen as a preferred means to achieving its long-term goals.

Exceptional Risk-Reward Scenario: The level of interest from large industry players now following QI Materials’ hydrogen exploration efforts is significant. Chances are QIMC will not exist in a year or so as with every positive news release it increasingly becomes a target for acquisition. The company recently had 9.915 million outstanding warrants exercised, which leaves the Company with sufficient capital to meaningfully facilitate exploration goals. Besides insiders, there are no more outside warrants outstanding. There are currently ~105M shares outstanding, ~40M of those shares belong to a handful of insiders; CEO John Karagiannidis (MBA, LL.B), Interwash’s (CFA), and ThreeD Capital. Good to invest where management has skin-in-the-game and understands the level of excitement surrounding what they have.

Currently trading on the CSE under the symbol QIMC, and Frankfurt under 7FJ, QI Materials is expected to start trading with a US listing in the coming week or so, this should facilitate additional liquidity, support, and demand for shares.

The following URLs have been identified for additional insight on QI Materials and the H2 industry:

– Company website: https://qimaterials.com

– CNBC article — Bill Gates-backed startup says a global gold rush for buried hydrogen is picking up momentum:

– Recent Follow the Money Podcast Spaces Interview on X with CEO & Chairman of QI Materials [Audio 43 min.]:

https://x.com/ftminvest/status/1834244706571555075?s=46

– Recent Mining Journal Article: https://miningmarketwatch.net/qimc.htm

##

Notice: Content above may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned.

Disclosure: The subject company of this article is not a client. Investor Opportunity has full editorial control of this article. The author has not been compensated to cover the subject company on Investor Opportunity. The author and/or its trading desk affiliate either owns now or plans on establishing a long position in the subject company.