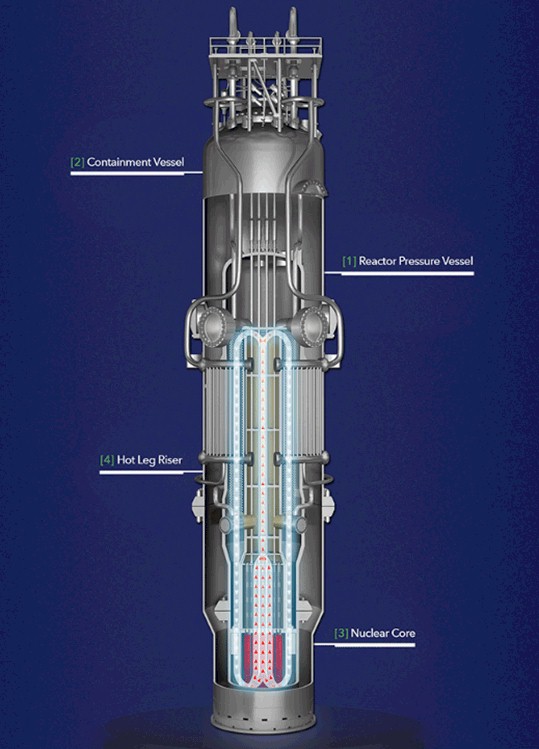

NuScale’s VOYGR Power Module which can generate up to 77 MW, the smallest light water reactors in the world. A client can add modules over time as power needs grow. The current market-cap relative to potential market appears undervalued.

NuScale Power (SMR) Small Modular Reactors are Gaining Attention of Utilities Globally

SHARE DATA, MARKETCAP, CORPORATE INFO:

NuScale Power Corporation

NYSE stock symbol: SMR

(Note: the stock symbol is also the acronym of the product the company makes; Small Modular Reactors)

Share Price: ~$11.31 on NYSE

Market Cap: ~$2.50 Billion USD

Shares Outstanding: ~220.4 Million (between both class A & B shares, caution when looking up info online as many finance sources only show info for class A, not combined)

Company website: https://www.nuscalepower.com

—— —— ——

NuScale Power Corporation was founded in 2007 and is headquartered in Portland, Oregon. NuScale became a publicly traded organization on May 2, 2022. NuScale Power Corporation develops and sells modular light water reactor nuclear power plants.

Here is a look at the NuScale’s VOYGR Power Module which can generate up to 77 MW. Image source: Company website https://www.nuscalepower.com/technology/design-innovations

NuScale makes the smallest light water reactors in the world. The rectors are modular and contain many of the systems all in one system that old reactors separate (Note in the image above: No cooling towers; NuScale SMR has the cooling unit contained inside of the reactor itself) — the result is a less complex system, and less complexity translates to less chance of an accident.

Modular = groundbreaking scalable technology for a world demanding more and more energy. Each NuScale reactor measures about 76 feet tall and 15 feet in diameter. A user/client can add modules one-by-one as their power needs grow over time. NuScale can provide up to 12 modules in one plant with up to 924 MW equivalent power output.

— Start cut and paste from NuScale’s website —

With the first ever small modular reactor (SMR) to receive U.S. Nuclear Regulatory Commission (NRC) design approval, NuScale is bringing the first VOYGR™ SMR power plant online in the U.S. this decade.

Our SMR technology, the NuScale Power Module™, generates 77 megawatts of electricity (MWe), resulting in a total gross output of 924 MWe for our flagship VOYGR-12 power plant. We also offer smaller power plant solutions in four-module VOYGR-4 (308 MWe) and six-module VOYGR-6 (462 MWe) configurations, though others will be possible. With an array of flexible power options, NuScale is poised to meet the diverse energy needs of customers across the world.

— End cut and paste —

NuScale recently received approval from the Nuclear Regulatory Commission (NRC), an independent agency of the United States government tasked with protecting public health and safety related to nuclear energy. However the approval was for the previous 50 MW design, not the 77 MW design NuScale intends to market.

SMRs are also space-saving and cost-saving: A SMR power plant of ~1,000 MW equivalent only needs an emergency planning zone of ~40 acres, compared to say 10 miles for traditional large legacy systems — this allows SMRs able to fit into tight spaces if need be. For the ultra-greenies that advocate unreliable wind and solar, NuScale SMRs use 90% less materials and 99% less land per MW hour.

The bottom line: NuScale’s technology and progress are contributing to it gaining more attention from utility companies around the world. The company only recently became publicly traded and is advancing tangible small modular reactor projects — NuScale has 18 active agreements with potential customers in 11 countries.; see latest related (September 12, 2022) press release “NuScale Power and KGHM Sign Task Order to Initiate the Deployment of First Small Modular Reactor in Poland”. In 2013, the Idaho National Laboratory and Utah Associated Municipal Power Systems (UAMPS) signed on as the company’s first customer as part of their Carbon Free Power Project at the Idaho National Labs — planning is for NuScale to deploy an operational power plant for UAMPS by 2029 with six power modules. It would generate 462 MW to provide power for about 700,000 homes. Also important to note is that the U.S. Department of Energy (DOE) agreed to a $1.4 billion cost share arrangement for the plant. Fluor Corporation is contracted to build the facility — Fluor is also NuScale’s largest shareholder, owning ~57% of the company today. NuScale also has an agreement for the deployment of SMRs in Romania. The current market-cap relative to potential market appears undervalued.

—— ——

Why Nuclear Power?: Nuclear power is increasingly viewed as belonging in the green energy sector, a power source that is both reliable and desirable as the best path forward to meet surging demands in baseload power, follow-through power, and peaking power across ever increasingly sophisticated electrical grids. Nuclear powers carbon footprint is negligible on a comparable basis; the concentration of energy in uranium is more than 1 million times oil and two million times coal. It’s safe, reliable, cheap, abundant, and clean.

Small modular reactors are smaller, manufactured reactors that are expected to be less expensive to build and operate. The following is what the US Office of Nuclear Energy has to say about SMRs:

SMRs and even smaller micro-reactors are the future, see the US Office of Nuclear Energy at https://www.energy.gov/ne/office-nuclear-energy for more on what is making its way from concept to reality near-term.

##

Note on timing a purchase: Currently we are in a general bear market for stocks, this makes stock picking timing difficult. Consider buying warrants instead of the stock if you want to limit risk. Don’t get mad if the stock goes down, be happy as you can get more stock at a cheaper price… so do not necessarily buy all in one tranche — the point here is, this appears a good company to scale into over the long run.

Notice: Content above may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned.

Disclosure: The subject company of this article is not a client. Investor Opportunity has full editorial control of this article. The author has not been compensated to cover the subject company on Investor Opportunity. The author and/or its trading desk affiliate either owns now or plans on establishing a long position in the subject company.

Recent Comments